Matthew Carter, Head of Marketing explores why investment is increasing in the BTR market

September 21, 2021

The impact of the pandemic varied across the property industry whilst it was undoubtedly challenging for many; it once again reiterated the resilience of the UK’s private rental sector (PRS). The sector’s reputation and stability make it an attractive investment choice, not just in London but across the UK. The emergence and continued growth of the Build to Rent (BTR) sector reinforces this point.

Our data and insight, powered by one million tenant references a year, shows a continued increase in achieved rents for newly let property. Those increases are driven by the sustained demand for housing and let property. There aren’t enough landlords in some areas and tenants are renting for longer tenancy terms. The BTR sector offers a viable route for growth in the level of quality rental stock on the market.

The growth of BTR has been fuelled by significant funds, banks, private businesses and investors entering the sector. News that British retail institution John Lewis is planning to build 10,000 rental homes highlights the intent and interest in the private rental market.

“Retailers are capitalising on repurposing existing property assets.”

The John Lewis Partnership identified 20 sites that could benefit local communities by providing quality and sustainable housing. The properties, which will range from studio flats to four-bedroom houses, will be built on sites owned by the chain, above Waitrose supermarkets or on land next to the company’s distribution centres.

Boots became the latest company to dip its toe into the property market. The pharmacy-led health and beauty retailer sold a plot worth £30 million to Ilke Homes, backed by TDR Capital. They plan to develop a ‘model village’ on the 43-acre plot, with 622 homes. The scheme will include 505 houses and 117 apartments, with a gross development value of more than £100 million.

The pandemic accelerated a digital shift across every industry, and more retailers could follow John Lewis and Boots in 2022 as they reduce their reliance on physical stores or make the most of unused land.

“Banks and private equity see the sector as a way to diversify their portfolios.”

Lloyds Banking Group has entered the BTR market by launching Citra Living, pledging to “help expand the availability of quality and affordable homes in the UK”. They plan to own and let around 800 properties before the end of 2022. This investment type helps to diversify the bank’s investment classes.

An estimated £1.2 billion was invested in BTR in Q1 2021, which is 335% higher than 2020. So far, property developers and institutional investors such as pension funds have invested in the BTR sector; whilst Lloyds is the first big bank set to become a landlord and take the strategic leap, I don’t think it will be the last.

“BTR developments offer lifestyle renting, with affordable options – giving tenants more choice.”

Tenants of a John Lewis-owned home can expect concierge service, a Waitrose convenience store as part of the development, and the property fully furnished with the department store’s products. These types of services and amenities like on-site gyms are becoming more commonplace in the sector. These features offer differentiation to other traditional properties available to tenants.

Whilst there might be a view that BTR only targets a narrow demographic, such as wealthy young millennials in urban areas, this isn’t the case in reality, with many developments focused on affordable living and houses as well as flats.

“Long term demand for new households will support the expansion of the sector.”

The Office for National Statistics forecasts that there will be more than four million new households by 2041, an increase of 17%. One of the significant benefits for developers is the sustained high demand in many areas from tenants. Having tenants checked and ready to take property help to create that immediate income and limit void periods.

It’s also vital that tenants get a wider choice of available properties. With a focus on the tenants’ needs, longer tenancy terms and reduced void periods, BTR could help deliver higher quality stock in the private rental market. The English Housing Survey highlighted that the standards in the PRS are lower than in the owner-occupied market. Any diversification of the stock in the PRS through BTR could help build the reputation for our sector even further.

“BTR investments will only become more prevalent, creating opportunities for managing agents.”

The creation of new households has slowed in the PRS, with some landlords feeling marginalised by the raft of legislation they’ve faced, along with reductions in tax support. And with tenants staying in property longer, that also impacts the level of churn in the market.

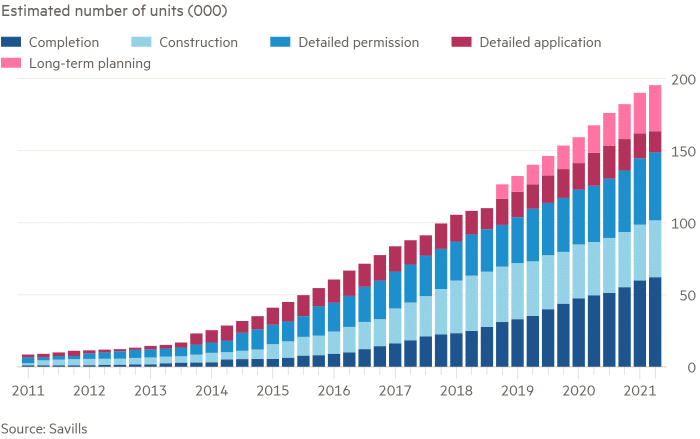

The BTR market currently accounts for 2-3% of the total stock in the PRS, but the key is its growth. The investment in the industry will only increase the level of planning and applications for new developments. The increase in new stock will create opportunities for professional lettings and managing agents to expand their businesses and drive additional growth.

Table: Build-to-Rent development in the UK